Publications

2025

The Consumer Climate Continues its Recovery in Parts

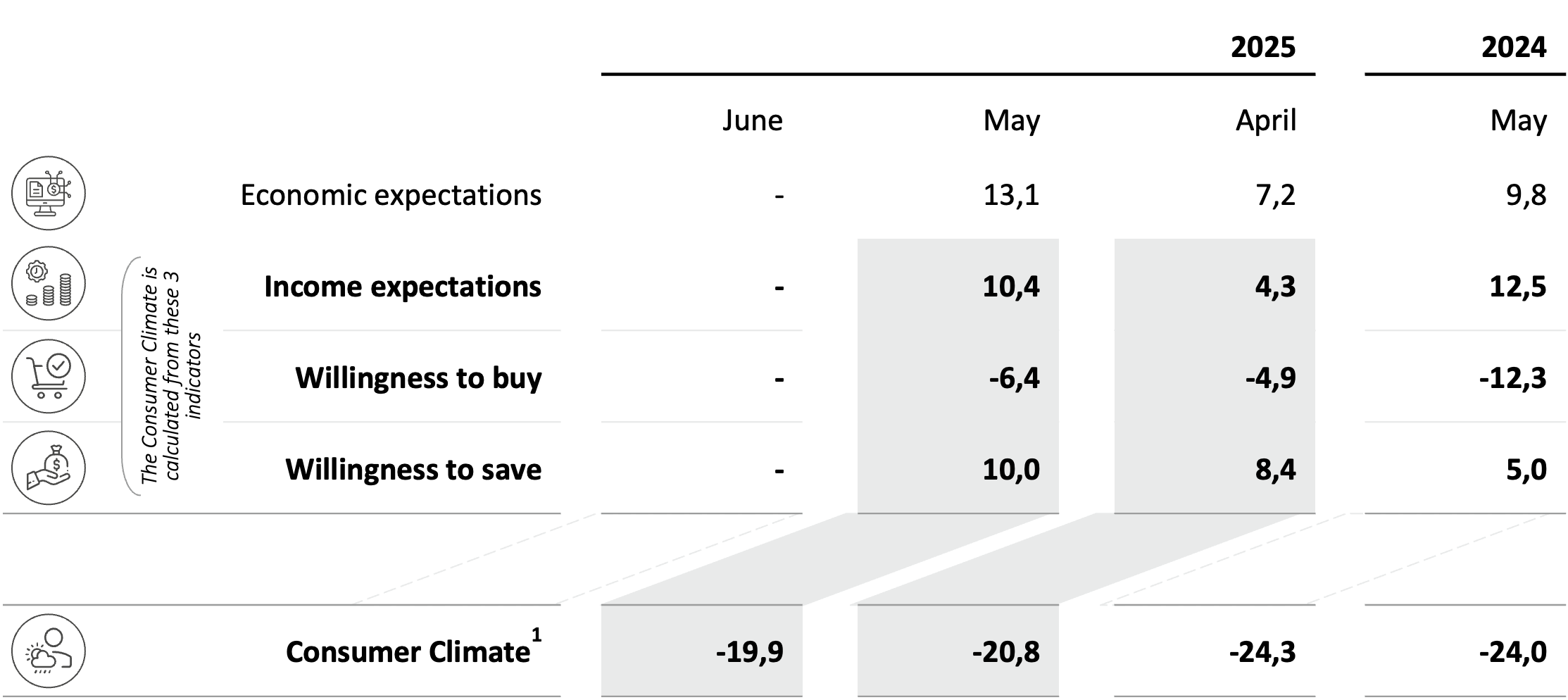

Nuremberg, May 27, 2025 – Consumer sentiment in Germany shows a mixed picture in May: economic and income expectations increase noticeably. In contrast, the willingness to buy falls slightly and the willingness to save increases again somewhat. The consumer climate indicator is forecasting a moderate increase of 0.9 points to -19.9 points for June 2025 compared to the previous month (revised -20.8 points). These are the latest findings of the GfK Consumer Climate powered by NIM, which has been published jointly by NIQ and the Nuremberg Institute for Market Decisions (NIM), the founder of GfK, since October 2023.

Both the slight decline in the willingness to buy and the increasing willingness to save are currently having a dampening effect on consumer climate and are preventing the noticeable growth in income and economic prospects from having a stronger impact on the Consumer Climate this month. The savings indicator rises by 1.6 points in May - following a significant decline in the previous month - and climbs to 10.0 points.

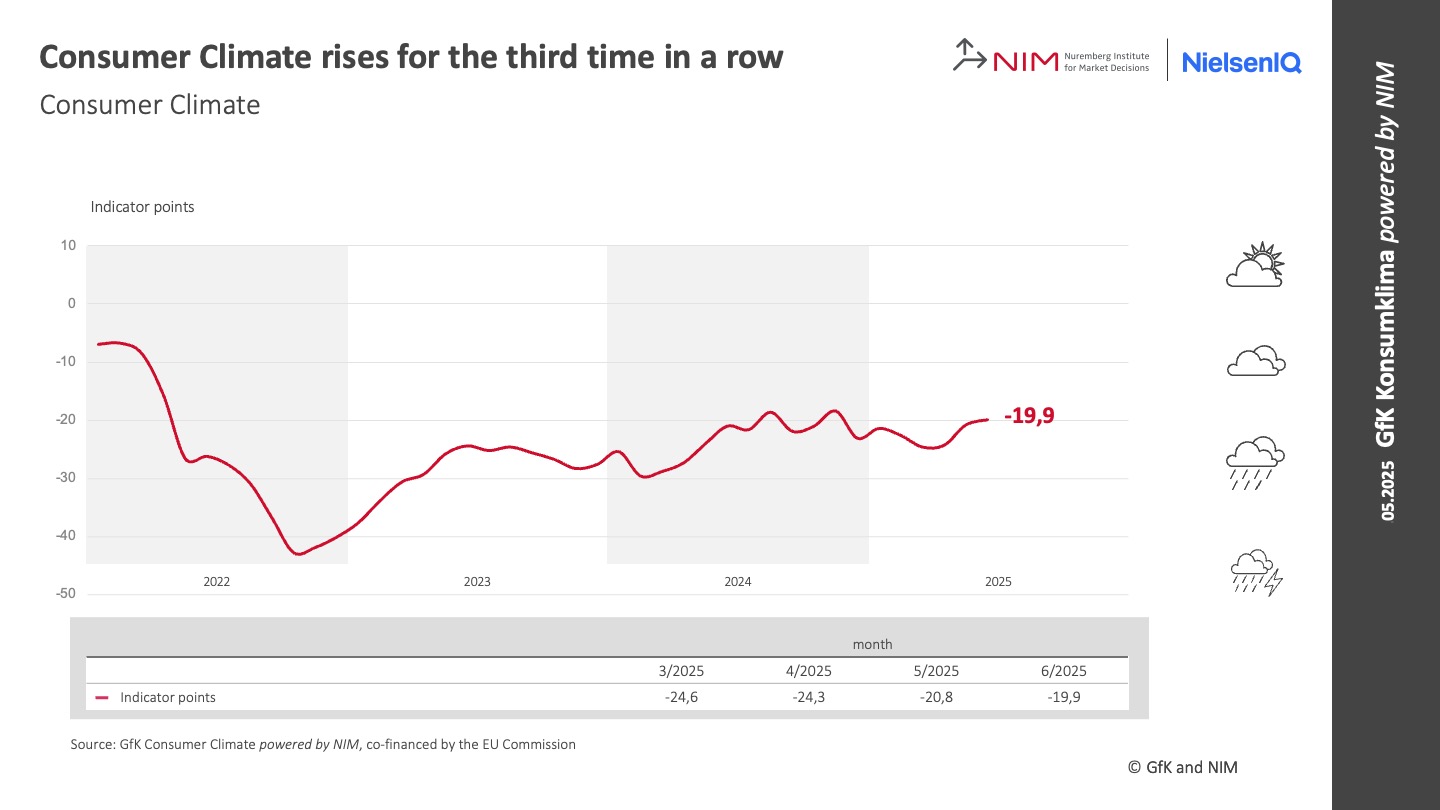

The Consumer Climate rises thus for the third time in a row, even if the increase compared to the previous month is moderate at 0.9 points. At -19.9 points, the Consumer Climate climbs to its highest level since November 2024, when -18.4 points were measured. "The level of consumer sentiment remains extremely low, and consumer uncertainty remains high," explains Rolf Bürkl, consumer expert at the NIM. "The unpredictable customs and trade policy of the US government, turbulence on the stock markets and fears of a third consecutive year of stagnation are reasons why the consumer climate remains weak. In view of the general economic situation, people seem to think it advisable to save."

Income expectations rise for the third time in a row

Consumers' income expectations increase noticeably in May. The indicator gains 6.1 points, climbing to 10.4 points. This is the highest value since October 2024 - when 13.7 points were measured. Compared to the same period last year, however, there was a small drop of 2.1 points.

There are reasons for consumers’ growing income optimism: Good wage settlements, such as the most recent one in the public sector (+3 percent this year and 2.8 percent for 2026), coupled with a slight slowdown in inflation are boosting purchasing power. According to the Federal Statistical Office, the inflation rate in April was 2.1 percent, compared to 2.2 percent in the two previous months.

The willingness to buy is not benefiting from improved income prospects

However, the willingness to buy cannot benefit from the noticeable rise in income prospects this month. After falling by 1.5 points, the indicator slips to -6.4 points. Compared to May 2024, however, an increase of just under 6 points was measured.

Despite improved income prospects, willingness to buy is not increasing. Uncertainty caused by the US government's unpredictable customs and trade policy and a rise in unemployment, which is causing many employees to worry about their own jobs, is continuing. This is causing consumer restraint, even though income expectations are currently viewed more positively.

Economic expectations climb to two-year high

Despite ongoing consumer uncertainty, their economic expectations for the next 12 months continue to rise: in May, the economic indicator increases by 5.9 points to reach a value of 13.1 points. This is already the fourth increase in a row. The last time a higher value was measured was about two years ago, in April 2023, at 14.3 points.

Consumer expectations regarding future economic developments are currently quite optimistic. However, it remains to be seen whether this optimism is justified. In its recently published spring report, the German Council of Economic Experts (Sachverstaendigenrat zur Begutachtung der gesamtwirtschaftlichen Entwicklung - SVR) assumes that no economic growth is to be expected this year. Next year, however, the German economy is expected to grow again at a rate of 1 percent.

The following table shows the values of the individual indicators in May 2025 compared to the previous month and previous year:

1Consumer Climate can be interpreted as a leading indicator of consumer behavior in Germany. Analyses have shown that sentiment is an early indicator for the actual development of private consumption. The Consumer Climate is calculated from the May values for income expectations, willingness to buy and willingness to save - as a leading indicator for the development of consumption in June 2025.

The following diagram shows the development of the Consumer Climate indicator over the last few years:

Planned publication dates in 2025 (CET):

- Thursday, June 26, 2025, 8 a.m.

- Thursday, July 24, 2025, 8 a.m.

- Wednesday, August 27, 2025, 8 a.m.

- Thursday, September 25, 2025, 8 a.m.

- Tuesday, October 28, 2025, 8 a.m.

- Thursday, November 27, 2025, 8 a.m.

- Friday, December 19, 2025, 8 a.m.

About the method

The survey period for the current analysis was from was from 1 to 12 May 2025. The results are extracted from the “GfK Consumer Climate powered by NIM” study and are based on around 2,000 consumer interviews per month conducted on behalf of the European Commission. The report presents the indicators in the form of graphics accompanied by brief comments. Consumer sentiment refers explicitly to all private consumer spending. Depending on the definition used, however, retail accounts for only around 30 percent of private consumer spending. Services, travel, housing costs, healthcare services, and the wellness sector as a whole account for the rest. Again, this does not apply to retail sales, but instead to total consumer spending. Like all other indicators, willingness to buy is a confidence indicator. It indicates whether consumers currently consider it advisable to make larger purchases. Even if they answer “Yes” to this question, there are two further requirements for making a purchase: The consumer must have both money required for such a large purchase and must also see a need to make this purchase. Furthermore, this only concerns durable consumer goods that also require a larger budget.

GfK Consumer Climate powered by NIM

The GfK Consumer Climate survey, which is being conducted regularly since 1974 and monthly since 1980, is regarded as an important indicator of German consumer behavior and a guiding light for Germany’s economic development. Since October 2023, the Consumer Climate data collected by GfK has been analyzed and published jointly with the Nuremberg Institute for Market Decisions (NIM), the founder of GfK. By joining forces, it will be possible to invest further in the analysis and development of the Consumer Climate study to gain an even better understanding of the background to changes in consumer confidence.

Media Contact:

NIQ: Corina Kirchner, T +49 911 395 4570, corina.kirchner@nielseniq.com

NIM: Sandra Lades, T +49 911 95151 989, sandra.lades@nim.org

About NIQ

NielsenIQ (NIQ) is a leading consumer intelligence company, delivering the most complete understanding of consumer buying behavior and revealing new pathways to growth. NIQ combined with GfK in 2023, bringing together two industry leaders with unparalleled global reach. Our global reach spans over 90 countries covering approximately 85 percent of the world’s population and more than $ 7.2 trillion in global consumer spend. With a holistic retail read and the most comprehensive consumer insights—delivered with advanced analytics through state-of-the-art platforms—NIQ delivers the Full View™.

For more information, please visit www.niq.com

Nuremberg Institute for Market Decisions e. V.

The Nuremberg Institute for Market Decisions (NIM) is a non-profit research institute at the interface between science and practice. The NIM investigates how consumer decisions change as a result of new technologies, social trends or the application of behavioral science and what micro- and macroeconomic effects this has on the market and society. A better understanding of consumer decisions and their effects helps society, companies, politicians and consumers to make better decisions in the interests of a socio-ecological market economy and "prosperity for all".

The Nuremberg Institute for Market Decisions is the founder of GfK.

Further information at www.nim.org/en and LinkedIn.

![[Translate to English:] [Translate to English:]](/fileadmin/_processed_/e/2/csm_R.Buerkl_NIM_22c3502ef5.png)