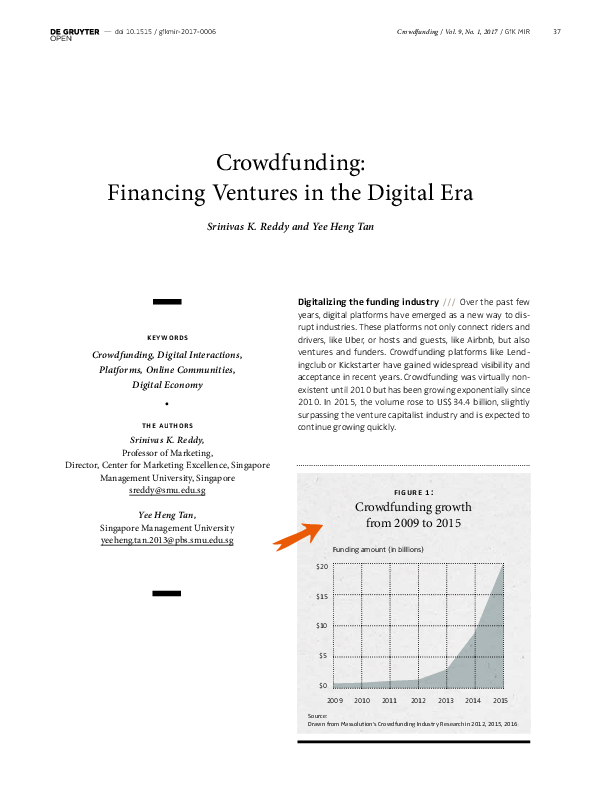

Crowdfunding: Financing Ventures in the Digital Era

Srinivas K. Reddy and Yee Heng Tan

Crowdfunding is a method of raising funds to support a venture, usually by raising small amounts from a large number of investors. Typically, a project creator posts a project on a platform seeking a certain amount of funds for some venture. Potential backers view the project and contribute money if they are convinced of the idea. In most cases, these backers receive something in return.

Crowdfunding helps facilitate projects that would otherwise have fallen through the cracks. There are many success stories, but the average success rates are moderate. To succeed, it is necessary to manage the expectations of diverse stakeholders during the entire funding and development process. Success factors range from selecting the right platform to accurate communication all along the way. Prior experience helps, as well as a realistic assessment of the chances, so as not to disappoint the community.

![[Translate to English:] [Translate to English:]](/fileadmin/_processed_/9/7/csm_2017_gfk_mir_digital_transformation_eng_Kap1_fb07b248fd.png)

![[Translate to English:] [Translate to English:]](/fileadmin/_processed_/d/e/csm_zott_amit_vol_9_no_1_deutsch__4f0cedf9b0.png)

![[Translate to English:] [Translate to English:]](/fileadmin/_processed_/9/9/csm_vanalstyne_parker_vol_9_no_1_deutsch__1022bf4f79.png)

![[Translate to English:] [Translate to English:]](/fileadmin/_processed_/a/9/csm_neus_ea_vol_9_no_1_deutsch_740bd10e36.png)

![[Translate to English:] [Translate to English:]](/fileadmin/_processed_/c/3/csm_reinartz_imschloss_vol_9_no_1_deutsch__afb033a673.png)

![[Translate to English:] [Translate to English:]](/fileadmin/_processed_/b/4/csm_menon_vol_9_no_1_deutsch__8c5353e150.png)

![[Translate to English:] [Translate to English:]](/fileadmin/_processed_/5/9/csm_bruce_vol_9_no_1_deutsch__010920cbc4.png)

![[Translate to English:] [Translate to English:]](/fileadmin/_processed_/0/d/csm_wulle_interview_vol_9_no_1_deutsch__6b16a3e232.png)