Chinese and US Digital Platforms: Exploring Key Differences in Strategies

Chinese and US platforms share common goals, but their strategies diverge due to cultural, regulatory and market forces.

Platforms as online backbones

In today’s digital age, platforms have become the backbone of online interactions, shaping the way we connect, communicate and conduct business. From social media, e-commerce and gaming to travel and hospitality, platforms have revolutionized industries and transformed the way we live and interact. Understanding the strategies employed by these platforms has become increasingly critical for businesses, researchers and policymakers alike. Chinese and US platforms have emerged as significant players in the global digital ecosystem, and while they share the common goal of user engagement and monetization, their strategies diverge significantly due to cultural, regulatory and market forces. We can gain valuable insights from comparing different types of platforms and their approaches to capturing market share, engaging users and driving revenue.

Social media platforms

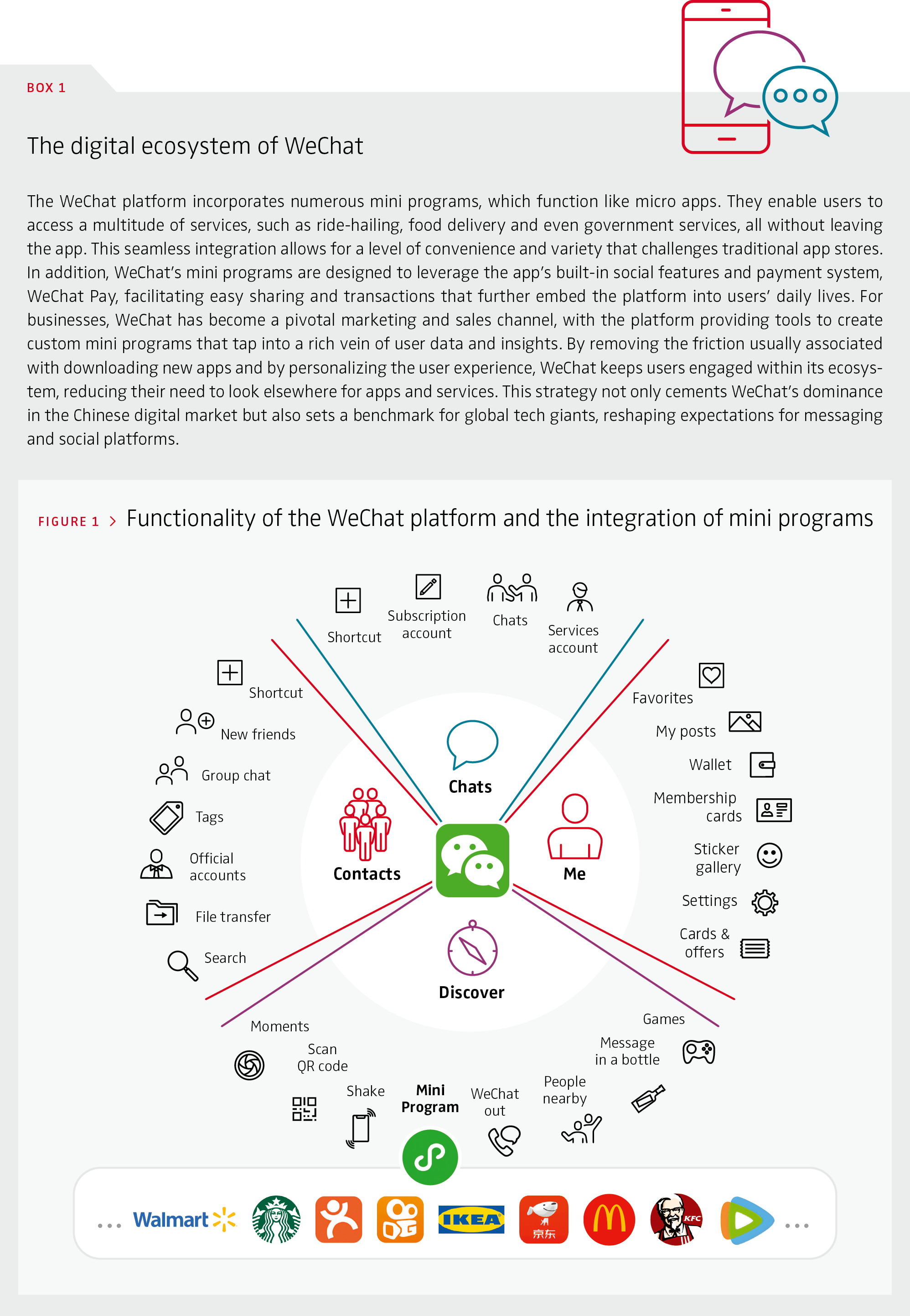

In social media, WeChat and Weibo in China have evolved into multifaceted ecosystems and are deeply integrated into the daily lives of Chinese users, offering a broad spectrum of services from messaging to payments and beyond. WeChat, for example, transcends its origins as a messaging app by incorporating “mini programs,” which effectively transform it into an expansive digital ecosystem (see Box 1 and Figure 1). Meta (formerly Facebook) and X (formerly Twitter), by contrast, have maintained more focused identities, with Meta creating a family of apps and X emphasizing its role as a real-time information network. Meta apps and WeChat mini programs diverge significantly in their approaches and in integration within their respective platforms. Meta apps typically function as stand-alone entities accessible through the Meta platform but often redirecting users to an external app or website, requiring separate downloads or new browser tabs. This means that while Meta’s apps can enhance user experience by connecting users with a variety of services, they do so in a way that is less integrated and more fragmented compared to WeChat’s approach. This distinction reflects the broader difference in philosophy between the platforms: Meta, with its suite of apps like Messenger, Instagram and WhatsApp, encourages users to navigate between different apps for different experiences, whereas WeChat consolidates these experiences into a single, cohesive interface, streamlining the user’s digital journey.

Chinese platforms often adopt a “super-app” strategy and create vast, integrated ecosystems that offer a wide array of services.

E-commerce platforms

The e-commerce sector demonstrates this divergence in design philosophy clearly, with Alibaba establishing itself as a marketplace facilitator, creating an extensive web of related services, including logistics, digital media, health services, financial services, and online and offline grocery stores. Amazon and eBay, while also powerful online retailers, are more focused on the business model of marketplace, emphasizing the customer experience and fast, reliable service. By establishing a robust logistics network through Cainiao, Alibaba ensures efficient delivery and fulfillment, which is critical in maintaining the flow of goods in its marketplace. Health services are addressed through AliHealth, which offers medical supplies and appointments, while Alipay and the Ant Group provide financial products like payment gateway, money market savings, loans and insurance, integrating financial services seamlessly into the consumer journey. Moreover, Alibaba’s foray into online and offline grocery stores through Freshippo caters to evolving grocery shopping habits, blurring the lines between physical and digital commerce. In contrast, Amazon has taken a more vertically integrated approach, maintaining tighter control over its value chain. It has built its own formidable logistics network, Amazon Prime, and has ventured into media through Amazon Prime Video, competing with traditional content providers. Amazon has also delved into the health sector with Amazon Pharmacy and has financial services like Amazon Pay. However, Amazon’s approach is to own and operate these services as extensions of the Amazon brand rather than as facilitators for a broader marketplace. eBay, on the other hand, has maintained a more focused approach, positioning itself primarily as an online auction and shopping website. It facilitates consumer-to-consumer and business-to-consumer sales but does not typically provide the same breadth of supplementary services as Alibaba. Instead, eBay relies on partnerships, such as its integration with PayPal for payment services, to provide a complete, yet less integrated, e-commerce experience. Each company – Alibaba, Amazon and eBay – illustrates a distinct interpretation of how an e-commerce entity can expand and diversify its offerings, whether it be through creating a universe of related services, integrating vertically or focusing on the core marketplace model with strategic partnerships.

Gaming platforms

Gaming platforms, such as Tencent Games and Steam, illustrate different models of operation. Tencent not only hosts games but also develops them and has a stake in many gaming companies, reflecting the integrated model preferred in China. Steam, on the other hand, serves as a global distribution platform and relies on its vast, diverse catalog of games from developers around the world.

Travel and hospitality platforms

Chinese travel and hospitality platforms, such as Ctrip and Feizhu, have built comprehensive ecosystems that cater to a broad spectrum of consumer needs within a single interface. These platforms not only facilitate hotel and flight bookings but also offer auxiliary services like restaurant reservations, local attraction tickets and integrated travel-related retail services. They leverage strong domestic demand and mobile-first consumer habits, providing an all-in-one super-app experience that aligns with the Chinese preference for platform consolidation and convenience. In contrast, US platforms tend to specialize more and often segment their services across multiple apps or websites. For instance, Expedia and Booking.com primarily focus on travel bookings, offering exhaustive options for flights, accommodations and car rentals, while platforms like Airbnb emphasize unique lodging experiences and local activities. US companies typically aim to provide depth in each service category, with a user experience characterized by a clear separation of services, which may require consumers to use multiple platforms to plan different aspects of their trip. This approach mirrors the US market’s preference for specialized services and the convenience of choice, allowing consumers to select platforms that best align with their specific travel needs.

Understanding strategic differences is crucial

The strategic differences between Chinese and US platforms are marked and multifaceted (see Figure 2). Chinese platforms often adopt a “super-app” strategy and create vast, integrated ecosystems that offer a wide array of services, aligning with the preferences for convenience and comprehensive platforms. They tend to be mobile-centric, reflecting the widespread use of smartphones for Internet access in China. In contrast, US platforms typically operate a suite of specialized services, focusing on maximizing the user experience and revenue within each platform. They often emphasize the quality of individual services, data privacy and a global approach that includes specialization and clear delineation between services.

> Understanding strategic differences allows businesses to adapt and develop effective strategies

Understanding strategies is the basis to thriving in the ever-evolving digital landscape and enables businesses to tailor their offerings to align with consumer preferences and to reach their target audience effectively. At the same time, a specific platform’s strategy can influence how consumers discover, evaluate and purchase products and services.

> Understanding platform strategies is equally essential for policymakers and regulators

For regulators, there are two important concerns: First, platforms often operate across borders, challenging traditional notions of jurisdiction and regulation. By studying their strategies, policymakers can gain insights into how platforms navigate regulatory landscapes and make informed decisions to protect consumers, ensure fair competition and foster innovation. Second, and perhaps more importantly, the growth of platforms is path dependent. Once a platform strategy is made, the development will interact with the social, cultural and economic environment and follow a complex trajectory. As this is not easily determined by the platform or regulated by the policymakers, it needs to be monitored closely.

Chinese and US platforms both aim to maximize user engagement and monetization but adopt markedly different strategies shaped by their respective sociocultural and regulatory environments. Understanding these strategic differences is crucial for businesses and policymakers to navigate the global digital landscape effectively.

FURTHER READING

Cennamo, C., & Santalo, J. (2013). Platform competition: Strategic trade-offs in platform markets. Strategic Management Journal, 34(11), 1331–1350.

Claussen, J., Kretschmer, T., & Mayrhofer, P. (2013). The effects of rewarding user engagement – The case of Facebook apps. Information Systems Research, 24(1), 186–200.

Hagiu, A., Farronato, C., Fradkin, A., & Lomax, D. (2024). Understanding the tradeoffs of the Amazon antitrust case. Harvard Business Review. hbr. org/2024/01/understanding-the-tradeoffs-of-theamazon-antitrust-case

Li, J., Pisano, G., Xu, Y., & Zhu, F. (2023). Marketplace scalability and strategic use of platform investment. Management Science, 69(7), 3958–3975.